Let’s begin with a paraphrased recap of Moore’s law: technology will continue to double in performance every two years. Now, predictions as to when exactly Moore’s law will come to an end – due to the physical restrictions of transistors and silicon chips – tend to focus on the year 2025 (beyond this point, we would require computer components smaller than a molecule, which at the moment is the type of technology befitting the Marvel Universe rather than our own).

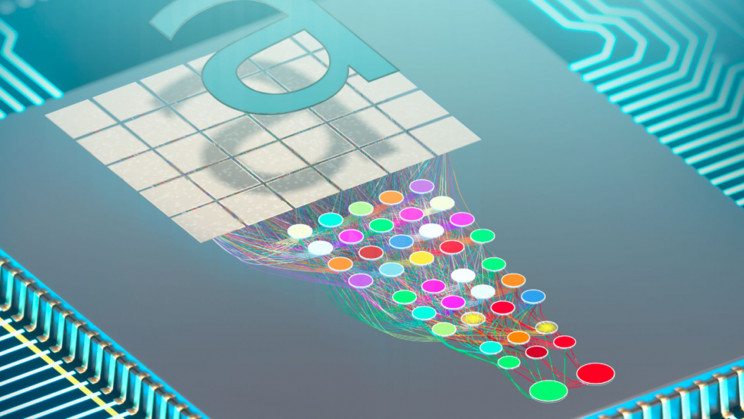

So, what will replace transistors beyond this point? Light beams, perhaps? With the advancement of quantum computing, which is due to land commercially within the next two decades, there’s every reason to confine Moore’s law to the history books and keep an investment eye on the ever forwards march of new tech.

Get in now while you can

Tech start-ups and SMEs are generally the brainchild of someone with a garage, a dream, and access to more tools and bits of metal than a shipyard. The thing is, TV shows where investors called buzzwords like Dragons or Sharks must choose whether to finance an entrepreneur are popular for a reason – there are plenty of start-ups with plenty of potential but very little business acumen. With expert Digital Due Diligence guidance, you could identify the most compelling investment opportunities in tech and make the smartest decision of your life (think Bechtolsheim and Cheriton, the first two investors in Google back in 1998 for only $100k each … a shrewd investment for a company now worth over $300bn).

What areas of tech are hot investment opportunities?

If you are looking to invest in tech, several areas of the industry look to be more progressive and vital to the future infrastructure of global developments than others. For example, areas of tech such as artificial intelligence, smartphones, cryptocurrency, the automotive industry, software development, and streaming media platforms (see how to follow up on investment opportunities in Netflix) seem to be here to stay. One of the best pieces of advice you can receive over any investment opportunity is to avoid what you don’t know and stick to what you love. After all, you’re far more likely to pay attention to the markets if you’re researching a personal passion than if you’re simply going through the motions to track an investment that means very little to you in your daily life.

Is tech a guaranteed investment?

In the short term, we would have to say that tech investments are not always guaranteed and returns may fluctuate. In the long term, investments are much safer. For example, the 2008 global economic crash saw a dip in returns for the tech sector of around 41%. However, in stark contrast, the following year saw market uncertainty dissipate somewhat with increased tech sector returns of around 50%. Between 2011 and 2017, returns varied between a low of under 3% to highs of 34%. Investing in tech is therefore a solid option, with returns rising by different amounts year to year – the decision of when to pull out is up to you!