Business people like to think in terms of exponential increase; 3% growth per year, for example, represents a doubling in 24 years. Using Piketty’s example regarding wealth concentration, 5% per year doubles one’s asset values in 14+ years. Renters, needless to say, see no appreciation.

Exponentially Declining Cost

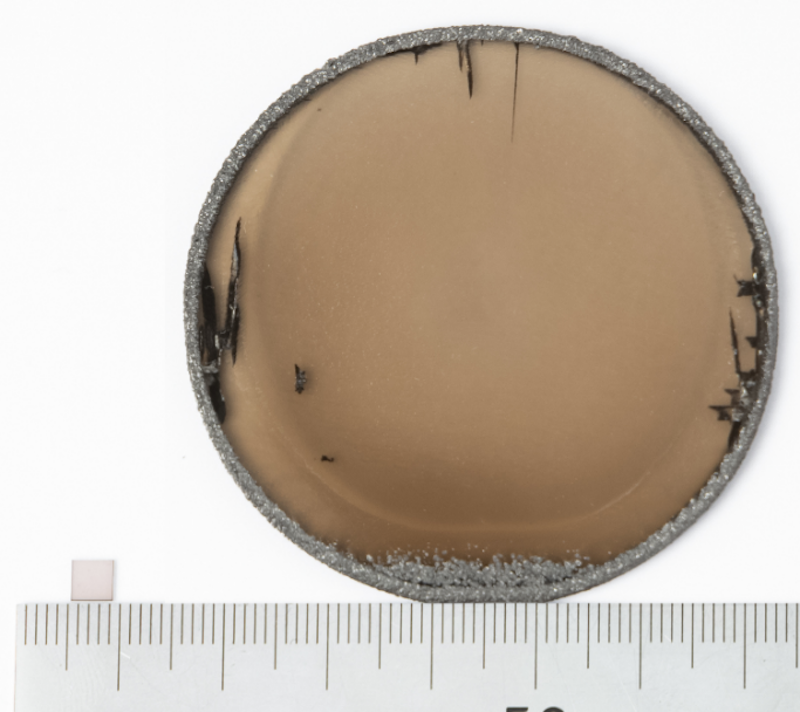

Exponentially increasing productivity, however, is a euphemism for exponentially declining cost. One outstanding example is photovoltaic solar power. If it declines at 20% per year, it approaches zero at a progressively slower rate over time. The curve begins at a historical high and initially declines steeply (see graph). One sees in the ‘short term’ a year over year decline of, for example, 50 cents per watt to 40 cents per watt. If one looks back ten years, however, one sees a price of $4 declining to 40 cents.

Every day that people show up for work, some number of them are responsible for ‘improving the bottom line’. Some view this as increasing sales, some view it as cutting costs, some view it as creating new products and services that disrupt incumbents. Since about one out of every 13 workers in the US is a business owner, this number is, presumably, no less than 7%. If one adds various managers, engineers, scientists, software developers, and consultants, the number could rapidly rise to 20% or 25%.

Incremental Improvement vs. Disruptive Change

At that point it isn’t a 20% decline in solar power anymore, it’s the cumulative effects of cheaper solar, better batteries, more efficient charge and load controllers, more efficient lighting, and so forth. Measured across the economy, one might see 3% improvement. A consumer that last bought a smartphone in 2010 sees something nearly unbelievable when they belly up to the counter in 2015. Replacing an incandescent light bulb with an LED equivalent might drop one’s power bill by $1 per month. Replacing the utility “intertie” with a solar power system and efficient appliances eliminates the power bill entirely – along with the billing clerks, power transmission lines, generating station, coal mine, and railroad shipments. The former is an ‘incremental improvement’, the latter is ‘disruption’.

Consumers are increasingly buying ‘disruptive’ rather than ‘incremental’ products and services. The earliest examples where digital started to overpower analog was with CD players. By the time the Internet became commercial in 1995, this process was in full swing, and entire industries were vaporized – including CDs.

Hints that a business or product line sits in the bulls-eye fo disruptive change might include:

- laws or regulations to ‘protect’ a business from upstarts, as one might find in banking, medical services, or taxis

- complicated logistics or a ‘long tail’ supply chain

- elements of the product ‘depreciate’ at different rates, such as batteries, CPU chips, or displays

- service presently involves substantial amounts of human intervention following strict guidelines or procedures

Businesses often think of finding a way to cut costs by enough to ‘preserve margins’, whereas an outsider targets ‘from the ground up’. When one is dealing with a hungry swarm, a single success is enough to overturn an entire industry.